Claiming expenses is one of the perks available to the self employed. However it is important to ensure that you are meeting HMRC requirements.

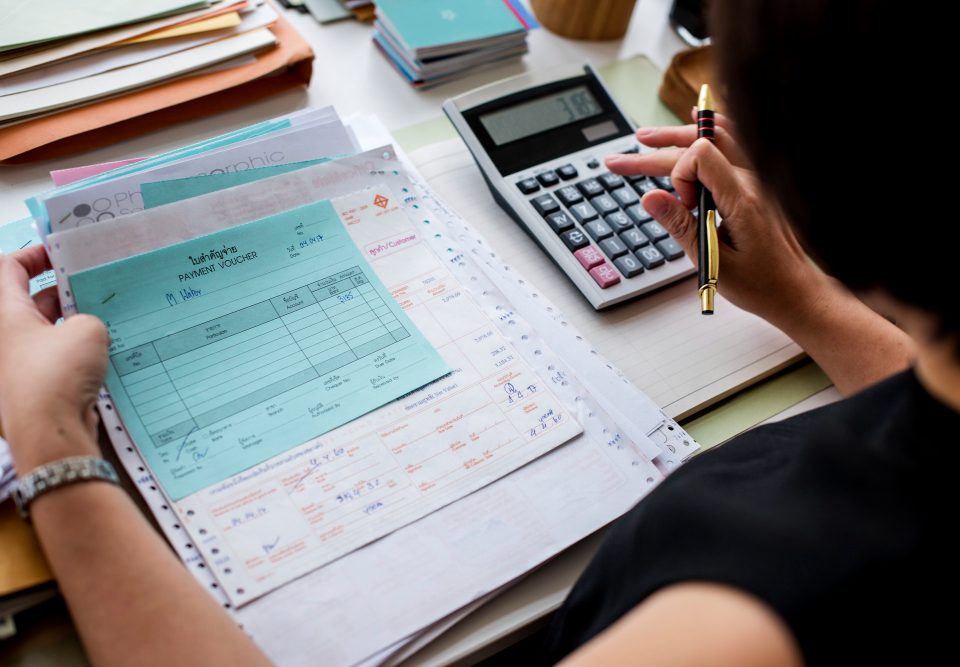

It may be time to focus on storing receipts and invoices electronically to safeguard them long-term. HMRC has guidelines and requirements for submitting and storing your paperwork electronically, so ensuring you’ve met the standards they’ve outlined will undoubtedly help you in the event of a HMRC investigation.

Furthermore, if you’re due a tax rebate, keeping your receipts and invoices will help maximise the amount you’ll get.

Always ask for receipts

Get into the habit of asking for receipts for all of your business transactions. This means that there will never be any doubt about what you’ve spent and how much you could claim.

For transactions completed online, storing receipts is a simple matter of hitting download. However, you should also make sure you’re saving your paper receipts electronically. Invest in a cheap scanner so you can send a copy straight to your computer every time. Or if you have decent phone camera, you can take a picture on your phone – just make sure the image is clear and everything on the receipt is readable.

Why should I store receipts and invoices electronically?

Over time, physical documents can easily be lost. HMRC holds the right to audit your claims retrospectively for up to 20 years (in the case of fraud or criminal activity); ordinarily, you’re required to retain proof of expenditure for 6 years. As receipts and invoices fade over time, scanning them in and electronically storing them will ensure you have required documents in a format that HMRC can read.

Furthermore, scanning and storing receipts digitally makes the process far easier for you.

It may take a bit of getting used to, but once you’re in the swing of things, you could ditch that boxfile/shoebox you’ve used all year and rather scan and store your receipts as you go along.

HMRCs requirements for digital invoices and receipts

Government-published conditions for electronic storage state that:

For scanned or photographed paper invoices “You may store what were originally paper VAT records in an electronic format as long as you can meet the requirements explained in this notice for ensuring authenticity, integrity and legibility. Authenticity and integrity must be maintained during the conversion process as well as during storage.”

Get organised

It’s easy to become overrun by mess and clutter but keeping your records in a state of disorder can cause issues when it’s time to fill in your tax return. Getting and staying organised means you won’t miss any receipts in the scramble to find everything. If electronic filing isn’t for you, try investing in a set of folders or files so nothing will go missing.

At Brian Alfred, we’re experts in all things tax. To find out how we can help, give our team a call on 0800 464 0358 or email tax@brianalfred.co.uk.