Tax is a subject of dread even for the most hardened of us. And though we try our best to stay on top of things, they just sometimes get left until the last minute.

This year, don’t let your finances get the better of you – give our blog a read to stay on top of your taxes. When the deadline rolls around, you’ll be glad you were prepared.

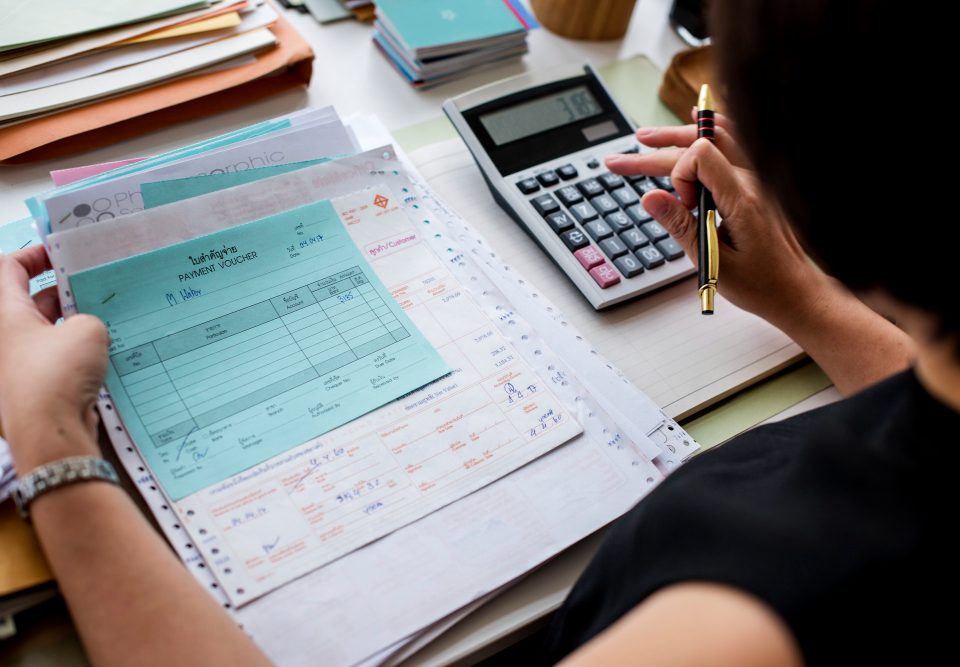

Keep track of your receipts

Falling into good habits will save you a massive headache later on down the line, so find a good system so you can easily keep track of your spends and your expenses.

The more prepared you are throughout the year, the less of a headache you’ll find sending off your return when tax time rolls around. Tracking your receipts throughout the year means you’ll be less likely to forget any of your expenses and in turn, you can maximise your rebate!

Don’t leave your return until last minute

When you’re busy, your tax return is bound to be the last thing on your mind. But investing a little bit of time each week storing and filing your papers will save you a world of difference when the deadline rolls around.

To help you out, we’ve put together some key dates for the tax year. Scribble these down and make sure you’re not caught unprepared.

Make the most of technology

Computers help to streamline every other aspect of your business. That’s why it’s only logical that you should follow the same process when it comes to your tax planning. For example, recording all of your expenses onto a spreadsheet might be an easy way for you to keep track of your money.

If you’d rather utilise your smartphone, there are plenty of free apps which make storing your receipts a doddle. You can find a selection here.

Ask for help if you need it

At Brian Alfred, our tax experts are here to make your life as simple as possible. Whether you have a tax question or you need a hand with your rebate, we’re here to help. Give us a call on 0800 464 0359 or visit our contact page to see how we can help.